Do Credit Repair Specialists Remove Judgements

Judgments can take a huge, lasting impact on your credit score, giving you major difficulty in obtaining credit cards or loans.

Perhaps you received a civil judgment from a lawsuit concerning old debt or even a former eviction. Whatever the reason, they crusade long-lasting damage, even years after the incident occurred.

Luckily, information technology is possible to have them removed before the usual end date. Find out everything y'all need to know near judgments, how they affect your credit score, and how you can go them removed even before they expire.

What is a judgment?

A civil judgment refers to a ruling made past a court during a lawsuit. Often, people have civil judgments considering of unpaid collections or other financial obligations. A judgment on your credit written report shows upwards equally a public tape placed at that place past the credit bureaus.

Anyone tin meet public records, and the three major credit bureaus collect them to testify time to come lenders your credit history. It's basically a decision by the court describing the outcome of the lawsuit.

How does a judgment impact your credit score?

A judgment is one of the most damaging things to have on your credit report. Different collections, which involve a dispute between two private parties and are almost always handled privately, a judgment occurs when a court-ordered mandate is to repay a debt.

This can occur in situations such as failure to pay child back up, alimony, or ceremonious and pocket-size claims lawsuits.

If you accept a judgment on your credit reports, it volition lower your credit score. Potential creditors will be hesitant to loan you coin because they tin can't trust that y'all'll repay the debt. Fifty-fifty if you're able to get a new credit card or loan, you can await some of the highest interest rates on the market.

How long does a judgment stay on your credit report?

A judgment remains on your credit report for seven years from the date it was filed. That means it volition negatively affect your credit scores for up to vii years. All the same, the negative impact weighs less and less, every bit fourth dimension goes on.

If you're still unhappy well-nigh having to expect that long, it is possible to have judgments removed from your credit report.

If you can get the judgment removed, you won't have to await up to vii years before being able to get a mortgage, car loan, or any other type of credit once again. Keep reading to see how you can get a judgment deleted from your consumer credit reports.

Unlike Types of Judgments

While all civil judgments are listed in the Public Records section of your credit report, there are a few unlike types of judgments to exist aware of.

Each one results from how y'all handle the initial judgment and can touch on your credit score differently. So read through each clarification carefully, so you know which situation could apply to you.

Unsatisfied Judgments

Unsatisfied judgments do the nigh impairment to your credit history. It means that you accept non addressed the result of the lawsuit whatsoever and the debt you owe has neither been paid nor settled.

The judgment creditor (who sued you to get the funds) has the right to forcibly collect the money if y'all refuse to pay or work out a settlement in a timely mode.

Otherwise, the unsatisfied judgment will stay on your credit report for the full seven years. Y'all might receive notice from the creditor at some betoken, or it may go untouched until it drops off; there's only no fashion to know. In some states, you lot may run the hazard of having an unsatisfied judgment re-filed, which nosotros'll discuss shortly.

Satisfied Judgments

A satisfied judgment is one that has either been paid or settled rather than remaining unsatisfied. It'south ideal to become your judgment satisfied as soon every bit possible because it's another blazon of debt that accrues interest. Every bit a result, the amount yous owe can quickly multiply.

Then how can you satisfy a judgment? There are a few unlike means. Get-go, you lot can pay the judgment in full. However, if that's not possible, yous can also negotiate a settlement, similar to any other mode you would for any other blazon of debt.

In extreme circumstances, you can get the judgment discharged past filing for bankruptcy. Finally, you lot can practice nothing and eventually have the judgment collected forcefully, ordinarily involving wage garnishment.

Once 1 of these options has been completed, your judgment volition switch from unsatisfied to satisfied on your public record and credit report.

A satisfied judgment is better for your credit history than an unsatisfied one. However, it all the same stays on your credit study for seven years from the engagement it was filed. Many people call up that once it'southward paid, the credit bureaus will remove the judgment from their credit report; however, that is not the case.

Vacated Judgments

A vacated judgment is essentially one that is dismissed through an entreatment. Vacated judgments should no longer appear on your credit reports. If it does, y'all can have information technology disputed as wrong reporting from the credit reporting agencies.

There are several ways to get your judgment vacated. The first way is to file a motion appealing the original ruling. It'southward quite common to successfully entreatment the verdict if the plaintiff didn't follow the proper legal process in the original lawsuit.

Procedural reasons might include non receiving a summons to court or receiving a default judgment without a hearing.

Most motions for appeal must be completed in person. Then, if yous no longer live in the jurisdiction where the lawsuit took identify, you'll demand to travel there to submit your paperwork and potentially attend another hearing.

If you win the appeal, you're entitled to a court document stating the dismissal of your example. So, you can send a re-create to the credit reporting agencies to expedite the removal process of the vacated judgment from your credit reports.

If it'due south non removed, yous should file a dispute with the credit bureaus, either on your own or through a credit repair visitor. Of course, a vacated judgment should never be listed on your credit report, but information technology's up to you to ensure that all the information is updated accurately.

Re-filed Judgments

Judgments are typically removed after seven years, just unfortunately, that's not always the cease of the story. Depending on the state in which you live, the judgment may be renewed, which means it tin can reappear on your credit study for another vii years.

In some states, judgments can be renewed indefinitely, meaning they'll keep showing up for years and years beyond the original filing date.

Take a look at the laws in the state where you live to decide whether your judgment can be revived. From there, you tin can figure out the all-time class of activeness to satisfy your judgment and have information technology removed for good.

What should I practise next fourth dimension if a debt collector sues me?

If you get sued, you volition need to pay the debt rapidly or appear before a gauge in court. The worst thing y'all can exercise is ignore the lawsuit. However, that'south precisely what most people do, so usually, the creditor wins by default as the defendant doesn't show up for court.

If you don't testify upwards or lose your case in court, a default judgment will be issued confronting you. Typically, you will be penalized by having a tax lien placed upon your house (if yous ain your firm) or having your wages garnished.

In some cases, you may even be forced to forfeit your belongings. These side effects are even more severe than the harm done to your credit score, so y'all actually need to address the lawsuit, become legal help, and evidence upwardly in court. Otherwise, yous have a long, hard route to financial recovery ahead of you.

It never hurts to talk to a legal professional alee of time to explore your options. But, at the very least, yous need to attend your hearing, then you don't automatically surrender your rights to a fair trial.

How to Remove a Judgment from Your Credit Report

Ready to get a judgment removed from your credit study earlier vii years? Here are three steps you can start today.

Step 1: Get the Court to Validate the Judgment

Kickoff by contacting the court direct. This means yous need to actually write a validation request alphabetic character to the courtroom that issued the civil judgment. The purpose is to have them verify that the judgment — and all the relevant details listed on your credit report — are accurate.

If the court can't do this or simply doesn't bother, as is oftentimes the case, you can asking to accept the listing removed past the credit reporting agencies. Under the Fair Credit Reporting Human activity (FCRA), a credit bureau must remove any information that cannot be verified. Simply exist sure to continue copies of all your correspondence sent and received and then yous tin dorsum upward your case.

Step ii: Confirm Any Data from the Court

If yous practise receive information back from the court verifying the details of your ceremonious judgment, take the time to make sure that it'due south all accurate.

All of this information goes through so many different touchpoints that there'due south a proficient adventure some of information technology was reported inaccurately.

Everything must exist error-free. That includes your name, balance, account numbers, dates associated with the account and judgment, and your account and payment statuses.

If you find anything that'south incorrect, yous can send a dispute letter to the credit bureaus and request that the judgment entry be updated or removed altogether.

Footstep 3: Get Professional Help from a Credit Repair Company

If disputing a judgment seems like a long and boring process, you're unfortunately right. That's why many people opt to hire credit repair companies to exercise the dirty work for them.

There are plenty of reputable companies that have high success rates in getting serious entries removed.

Get Your Judgment Removed Today!

If you're looking for a reputable credit repair company to aid you remove a judgment from your credit written report and repair your credit, we highly recommend Lexington Law.

Telephone call them at (800) 220-0084 for a costless credit consultation. They have helped many people in your state of affairs and have paralegals standing by waiting to take your phone call.

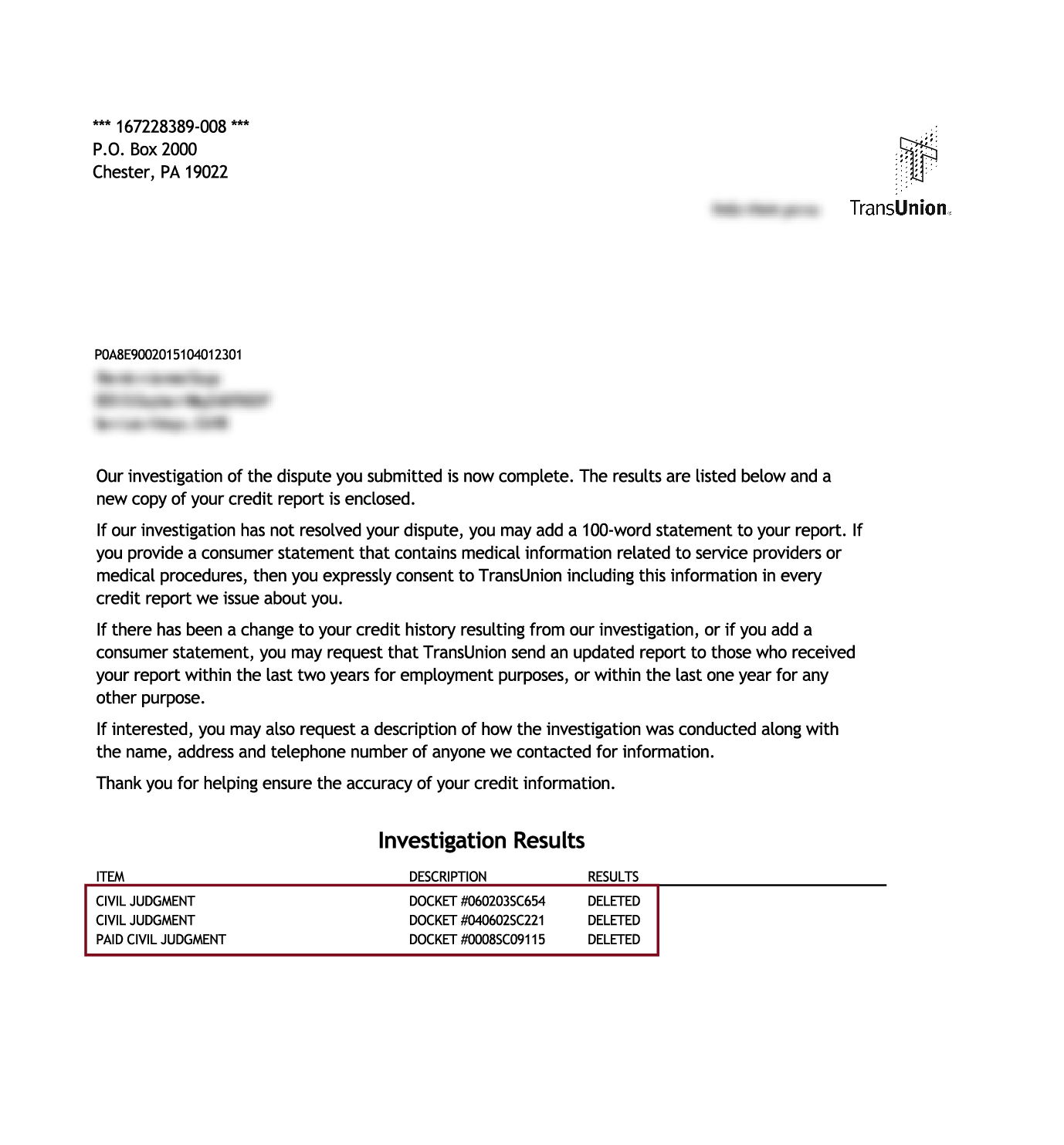

Civl Judgments Removed

What Others Are Saying

WOW! The service with you guys is unbelievable! Thanks for all your help. Yous guys are helping me build a ameliorate future. Thanks.

— K.Due west., Lexington customer

I simply wanted to thank you for what you have done thus far… I am looking forwards to the twenty-four hours when my credit reports will be looking like new again. It's a pleasure to have you on my team. Give thanks You.

— L.S., Lexington client

Disbelieve for Family unit Members, Couples, and Active Military machine!

Lexington Police is now offering $fifty off the initial set-up fee when you and your spouse or family members sign up together. The one-time $fifty.00 discount will be automatically applied to both yous and your spouse's first payment.

Active war machine members also qualify for a 1-time $50 discount off the initial fee.

Source: https://www.crediful.com/how-to-remove-judgment-from-credit-report/

Posted by: richfror1964.blogspot.com

0 Response to "Do Credit Repair Specialists Remove Judgements"

Post a Comment